June 19, 2021

Market Recap Week Ending June 18 (everything you wanted to know about dot plot charts but were afraid to ask)

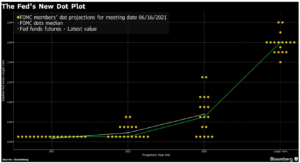

The week in review…Dow (1189) or (3.4%), Nasdaq (40) or (0.28%), and the S&P (82) or (1.9%). All eyes were upon the Fed this week and the central bankers did not disappoint. Despite Chairman Powell’s insistence that pricing pressures were transitory in nature and that there was no change in the timeline to raise interest rates, the Dot Plot chart (see below) indicated that the Fed body now expects interest rates to rise in 2023. Previously, the Fed had expressed confidently that rates would not rise until 2024. That was enough to spook the markets lower on Wednesday. The re-opening cyclical value trade continued to get hit on Thursday and then on Friday, St. Louis Fed President, James Bullard, a non-voting member, said on an interview on CNBC, prior to the market open, that he believed the first interest rate hike would occur next year. That statement sent all three indices lower, with the old economy Dow getting hit especially hard. All eyes will be upon the Fed again next week as St. Louis Fed President Bullard speaks on Monday. Will he walk back his comments from Friday? Following him on Tuesday, Fed Chair Powell will speak. How will he respond to his colleague’s comments from Friday? Despite all the inflationary talk, commodities traded off sharply this week, the dollar appreciated against major foreign currencies and the 10-year yield fell 1.5 bp to 1.438%.

|

Understanding the Federal Reserve’s Quarterly “Dot Plot” The “dot plot” shows projections for the federal funds rate … a key short-term interest rate that can affect savings yields and consumer loan rates.

www.schwab.com

|

What we are watching next week…

Monday – St. Louis Fed President Bullard speaks. Will he walk back his Friday statement?

Tuesday – Fed Chair Jerome Powell speaks, May Existing Home Sales.

Wednesday – Markit Manufacturing and Services Flash PMI, KB Home (KBH) reports earnings $1.63 EPS on $1.48 bn revs.

Thursday – Initial Jobless Claims, May Durable Goods Orders, Nike (NKE) $0.51 EPS on $11.09 bn revs, FedEx (FDX) $4.98 EPS on $21.47 bn revs.

Friday – May Personal Income, May Consumer Spending

Last week’s trading…

Monday – Dow (86) to 34,393, Nasdaq +104 to 14,174 (new record high) and the S&P +7 to 4,255 (new record high). Apparently, inflation fears are a thing of the past as growth stocks regained their mojo and pushed the Nasdaq and S&P to new highs. The 10-year yield rose 3 bp to 1.485% as six of the eleven S&P sectors traded higher led by Technology and Communication Services. The laggards were Financials and Materials. Tomorrow begins the two-day Fed meeting and a slew of economic data….

Tuesday – Dow (94) to 34,299, Nasdaq (101) to 14,072 and the S&P (8) to 4,246. As of yesterday, inflation didn’t matter. Today, the pendulum swung back, and the economic data that was released added fuel to rising inflation fears. The Producer Price Index (PPI) rose 6.6% over the last 12 months, the fastest increase since the data began to be tracked starting in 2010. Month over month the PPI rose 0.8% which exceeded economists’ expectations of a 0.5% increase. The double whammy came with the release of May Retail Sales which fell 1.3% vs expectations of an increase of 0.6%. Six of eleven S&P sectors traded down today led by Real Estate and Tech. The two best performing sectors were Industrials and Energy…Oracle (ORCL) reported better than expected numbers and traded down post-session 2.44%…Children’s online gamer Roblox (RBLX) fell 6.41% after reporting a decline in May active users…The U.S. 10-year yield traded up nearly 2 bp to 1.498%…All eyes now fall upon Chairman Powell’s press briefing tomorrow and any hints therein of tapering asset purchases….

Wednesday – Dow (265) to 34,033 , Nasdaq (33) to 14,039 and the S&P (23) to 4,223. The much-awaited conclusion of the Federal Reserve Open Market Committee meeting occurred along with the briefing from Chairman Powell. And while the Fed Chair said nothing that deviated from his previous comments, reiterating that the central bank believes that inflation pressures are transitory, a piece of information monitored by Fed observers caught their attention and sent the markets lower. The Dot Plot chart shows where each Fed member believes the Fed Funds rate will be in the future. This meeting showed many members believe that they will need to start raising rates in 2023 when previously it had been stated that there would be no interest rate hikes until 2024 and that is what pushed the markets lower today…All eleven sectors of the S&P traded lower with Consumer Staples and Utilities the worst performers…As one would expect, the U.S. 10-year Treasury yield jumped 8 bp on the news to 1.576%…Housing starts jumped to 1.57 million units in May, beating April’s 1.52 million starts but missing expectations of 1.63 million due to expensive lumber and a shortage of other building materials….

Thursday – Dow (210) to 33,823, Nasdaq +121 to 14,161 and the S&P (2) to 4,221. Jobless claims rose to 412,000 claims vs last week’s 376k print and expectations for 359k claims. The Philly Fed factory activity number declined for a second month in a row to 30.7 vs expectations of 31 and 31.5 for May. The U.S. 10-year yield declined 6 bp to 1.518% and commodity prices and commodity companies retreated aggressively. Six of the eleven S&P sectors traded higher led by Technology, Healthcare and Consumer Discretionary. The reopening cyclical trade took it on the chin today with Industrials, Materials, Financials, and Energy all trading down between 1.5% – 3.5%. The Chinese government released reserves of key metals, attempting to cool down speculation in the asset class. It appeared to work as prices on everything from palladium to platinum to corn futures, copper and oil declined. The dollar also appreciated which contributed to the falling prices of commodities. The Dow traded down for the fourth consecutive session. Has the cyclical, value, old economy trade run its course?

Friday – Dow (533) to 33,290, Nasdaq (130) to 14,030 and the S&P (55) to 4,166. In an interview with CNBC this morning prior to the market open, St. Louis Fed President James Bullard, a non-voting member, said he believed the first interest rate hike would occur next year in 2022, even sooner than the revised estimate from the Dot Plot chart this week which seemed to point to 2023 for the first interest rate hike. His comments sent the futures spiraling; all three indices opened down and finished near or at their respective lows of the day. Eight of the eleven S&P sectors traded lower led by Energy, Financials and Materials. Surprisingly, Tech was the best performer of the day, up 1.17%. The 10-year Treasury yield fell 7 bp to 1.438%.

P.S. If you know of family or friends who could benefit from our services and these types of communiques, please know that we are here to help and are accepting new clients at this time.

Disclaimer: This is not a recommendation to either buy or sell any of the securities listed above. I personally, or a family member’s account for which I control, own the following…Bitcoin (coin), Cardano (coin), Chainlink (coin), Ethereum (coin), ETHE, GBTC, and TSLA.