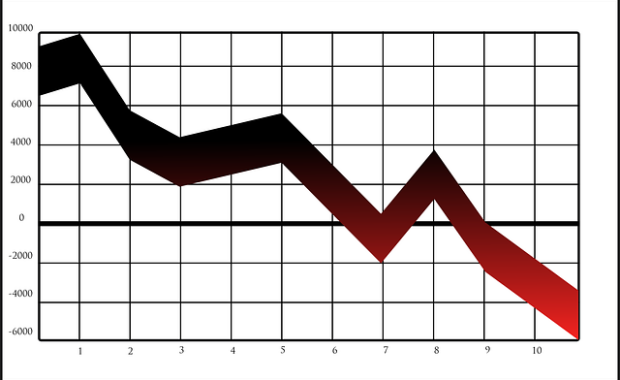

Indices Dow 37,986, +3 or +0.00%. Nasdaq 15,282, -893 or -5.52%. MSCI EAFE 2236.31, -53.45 or -2.33%. S&P 4,967, -156 or -3.05%. USD10Y 4.615%, +11.6bp or +2.58%. WTI Crude $82.70 bbl, -$2.82 or -3.30%. Repricing Continues Given Rate Cut Disappointment The Israeli retaliation for Iran’s drone and missile strike last week was largely ignored by the markets. In

Our advisors can help manage your investment portfolio to support you in retirement. Guide your choices in your employer’s 401k, Rollover accounts, Defined benefit plans, and retirement planning for your business.

Education Planning

Information on the tax benefits of a college savings plan

Our college investment experts can build a college savings plan to support the education needs of your family through growth and tax benefits.

Expert financial coaching

for your family

Don’t make critical financial decisions, that will impact your financial future, alone. Let us be your family financial coach and help you understand investing strategies.

RETIREMENT FINANCIAL PLANNING

No matter your age, a Marin Wealth Advisors retirement planner can help you invest in your future.

Marin Wealth Advisors

Insight. Integrity. Experience.

Years of exposure to up-and-down and mixed market cycles have taught us what works and what doesn’t in the art and science of investing. These insights and experience directly help our clients in optimizing their returns while avoiding unnecessary risk. Oakland, Marin County, San Francisco, and Walnut Creek, CA offices financial advisors and planners – we offer another advantage for our clients: fee only charging.

Our Philosophy

Every client, large or small, deserves honest and independent investment advice.

Investment management should be done by a Fiduciary.

Individual clients should pay no more than large institutions for investment management.

Investment decisions should be driven by each client’s investment goals and risk profile.

Sticky Inflation Sinks Markets, Escalation in the Middle East – Apr 12 Market Recap

Indices Dow 37,983, -1,001 or -2.57%. Nasdaq 16,175, -74 or -0.46%. MSCI EAFE 2289.76, -27.60 or -1.19%. S&P 5,123, -81 or -1.56%. USD10Y 4.499%, +12.1bp or +2.76%. WTI Crude $85.52 bbl, -$1.21 or -1.40%. Sticky Inflation Sinks Markets, Escalation in the Middle East It was just a bad week all around and the weekend brought no respite. Wednesday and Thursday

Profit Taking, Kashkari, Strong Jobs Report Pressure Markets – Apr 5 Market Recap

Indices Dow 38,904, -571 or -1.45%. Nasdaq 16,249, -179 or -1.09%. MSCI EAFE 2317.36, -34.21 or -1.45%. S&P 5,204, -30, or -0.57%. USD10Y 4.378%, +16.0bp or +3.79%. WTI Crude $86.73 bbl, +$5.92 or +7.33%. Profit Taking, Kashkari, and Strong Jobs Report Pressure Markets Profit taking was the name of the game to begin the week as the S&P had not had a 2%